Pharmacy 101: Top 3 money-saving tips on prescription drugs

If you are on Medicare: Check out the top 3 money saving tips here.

Formulary is the official name for the list of medications covered by your Bright HealthCare plan. It is sometimes called a “Drug List.” After you’ve read about how to use the formulary, this page helps you save money.

Find your co-pays or co-insurance by tier.

Pharmacy 101: Prescription costs and coverage for individuals and families

Want to go straight to the Formulary?

How can I spend less on my medications?

There are several ways to save money on your prescription drugs.

90-day supplies: Many drugs can be filled for a 90 day supply. Filling your drugs for a 90 day supply will save you money as you will get 3 months of your drug and only pay a two and a half month copay or coinsurance

Lower tier options: Picking a similar drug to treat your condition on a lower tier will help save you money. We recommend you bring the formulary with you when visiting your doctor to assist in choosing a lower cost drug.

Generic drugs: Generic drugs will typically cost you less. Generic drugs are identified on the formulary in Bold italicized, lower-case letters.

Condition-specific examples

Check your summary of benefits to determine the cost you will pay for each tier. For example, a plan may have the following copays:

- Tier 1: $0

- Tier 2: $30

- Tier 3: $150

- Tier 4: $250

- Tier 5: 40% coinsurance

- Tier 6: $0

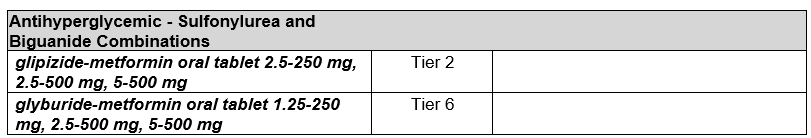

Example scenario: Your doctor is considering prescribing glipizide-metformin oral tablet to treat your diabetes. You look at the formulary and find that glipizide-metformin oral tablet is on Tier 2, which will cost $30 per month based on the example copays above.

You and your doctor also see there is another drug in the same class on a lower tier:

Glyburide-metformin oral tablet is on Tier 6. Based on the example copays, it will cost you $0 per month.

This would be a savings of $30 per month or $360 per year.

Check your summary of benefits to determine the cost you will pay for each tier. For example, a plan may have the following copays:

- Tier 1: $0

- Tier 2: $30

- Tier 3: $150

- Tier 4: $250

- Tier 5: 40% coinsurance

- Tier 6: $0

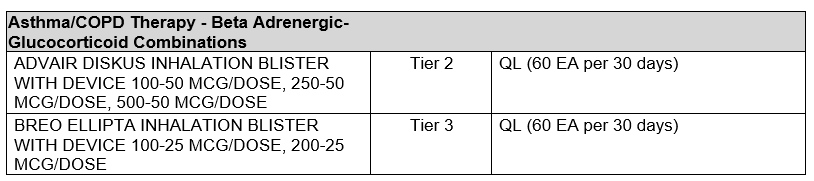

Example scenario: Your doctor is considering prescribing Breo Ellipta Inhalation Blister to treat your asthma. You look at the formulary and find that Breo Ellipta is on Tier 3, which will cost $150 per month based on the example copays above.

You and your doctor see there is another drug in the same class on Tier 2: Advair Diskus Inhalation Blister. Based on the example copays, it will cost you $30 per month.

This would be a savings of $120 per month or $1,440 per year.

Check your summary of benefits to determine the cost you will pay for each tier. For example, a plan may have the following copays:

- Tier 1: $0

- Tier 2: $30

- Tier 3: $150

- Tier 4: $250

- Tier 5: 40% coinsurance

- Tier 6: $0

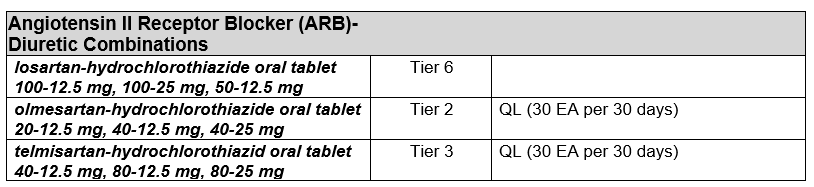

Example scenario: Your doctor is considering prescribing telmisartan-hydrochlorothiazide oral tablet to treat your blood pressure. You look at the formulary and find that telmisartan-hydrochlorothiazide oral tablet mg is on Tier 3, which will cost $150 per month based on the example copays above.

You and your doctor also see there are 2 other drugs in the same class on a lower tier:

Losartan-hydrochlorothiazide oral tablet on Tier 6. Based on the example copays, it will cost you $0 per month.

This would be a savings of $150 per month or $1,800 per year.

Olmesartan-hydrochlorothiazide oral tablet is on Tier 2. Based on the example copays, it will cost you $150 per month.

This would be a savings of $120 per month or $1,440 per year.